Commitment to Paying Fair Tax: How GBC accredited organisations lead the way with transparency and responsibility

20th May, 2025

Good Business Charter (GBC) accredited organisations must communicate their commitment to paying their fair share of taxes, avoiding legal tax avoidance and maintaining transparency in their relationship with HMRC, as we believe paying fair tax is crucial in creating a fair society for all.

The estimated tax gap from companies not paying their fair share is a staggering £36 billion (HMRC, 2023) and 70% of the UK public said they would prefer work for and shop at a businesses that can prove they pay their fair share of tax (Fair Tax Foundation, 2024). IBE research also shows that corporate tax avoidance continues to be the top ethical concern for the British public, marking the 12th consecutive year it has held this position (IBE, June 2024).

This case study will look at how some of our accredited organisations are setting out their approach to paying fair tax, clearly communicating this to their customers, employees, suppliers and the public, as required by GBC accreditation.

Showcasing fair tax through responsible business reports

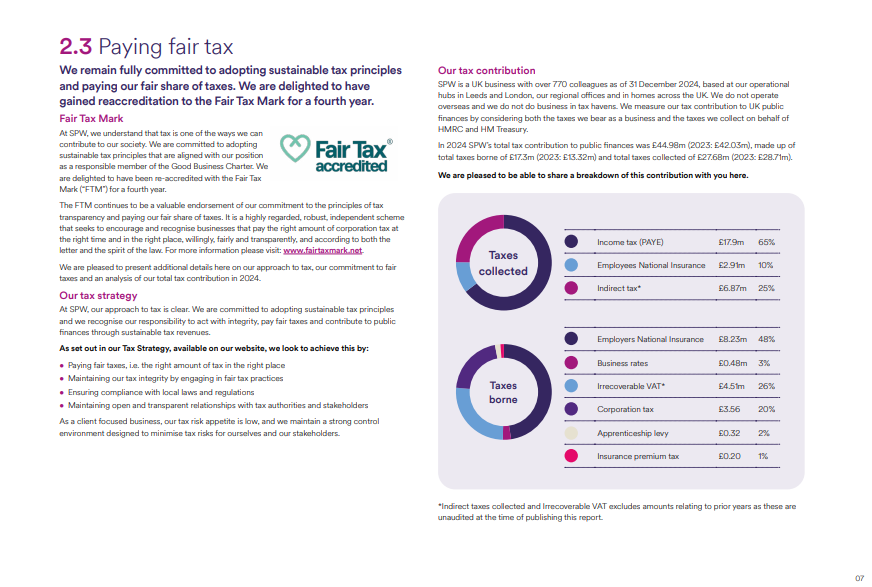

Schroders Personal Wealth, a national wealth management business, and Praetura Group, a financial services company, are just a couple of examples of GBC-accredited organisations who report on their responsible business commitments and progress within the framework of their GBC accreditation. Within their reports, they also set out their approach to Paying Fair Tax.

In addition, Schroders Personal Wealth is also accredit with the Fair Tax Mark, this is not a requirement of GBC accreditation although we work with the same principles.

Page 4 & 7 of Schroders Personal Wealth’s 2024 Responsible Business Report showcasing their commitment to paying fair tax (Click on the image to view the full report)

Page 19-20 of Praetura Group’s 2024/2025 Impact Report showcasing their commitment to paying fair tax (Click on the images to view the full report)

Demonstrating fair tax commitment through a dedicated webpage

Leeds Building Society demonstrates its commitment to fair tax with a dedicated webpage titled “Why we care about Fair Tax”. The page outlines their transparent approach to tax and highlights how paying the right amount is key to building trust and accountability and why they’re both Good Business Charter and Fair Tax Mark accredited.

The page articulates their approach to tax transparency and responsibility, emphasising their dedication to demonstrating their ethical business practices to the broader community.

Making tax transparency easy to access

Alex Mann Solutions, a security and commercial investments consultancy and SME, is certified by both the Good Business Charter and the Fair Tax Mark. Its Tax Policy is clearly linked from the Fair Tax Mark logo on the homepage of their website, offering immediate and transparent access to their stance on tax. It’s a strong example of a small business demonstrating visible corporate responsibility and ethical practice.

Alex Mann Solutions, a security and commercial investments consultancy and SME, is certified by both the Good Business Charter and the Fair Tax Mark. Its Tax Policy is clearly linked from the Fair Tax Mark logo on the homepage of their website, offering immediate and transparent access to their stance on tax. It’s a strong example of a small business demonstrating visible corporate responsibility and ethical practice.

Integrating fair tax into broader ethical commitments

AV Dawson, operator of Port of Middlesbrough, takes a simple yet effective approach to outlining their Fair Tax commitment alongside their other GBC values. This model is especially useful for smaller organisations seeking to incorporate ethical principles into their public-facing communications without requiring complex reports.

Setting the standard

We are incredibly inspired by the dedication of our GBC accredited organisations and particularly the accredited organisations featured in this blog, who communicate their commitment to paying fair tax for a better society, in such clear, transparent and public ways. These organisations have not only recognised the importance of paying fair tax – in the spirit of the law, not just to the letter of the law – but have also taken concrete steps to communicate this clearly to their customers, employees and supply chains, to promote a better society for all.

Our hope is that GBC accredited organisations lead the way in encouraging other organisations to adopt an ethical and responsible approach to paying their fair share of tax.